Problem Statement:

Seamless management of finance operations is one of the critical features for any ERP application. Most of the finance related transactions in any business will be routed through the bank account. Bank account balance in ERP application and account balance in a bank account should be reconciled more often. ADempiere has very good bank account management feature and it very nicely integrated with finance systems. In ADempiere, all bank transactions are routed through In-Transit account but not the actual account of the bank. But These transactions should be posted into actual account through Bank Reconciliation process. We need to understand how Bank Reconciliation works in ADempiere

Scope of Article:

As a part of this article, we will discuss how Bank Reconciliation can be performed in ADempiere and it also explains complete life cycle from bank creation to reconciliation with an example.

Technology :

ADempiere 342 or above.

Details :

Let us take an example of application, Where

- We will create Vendor/Customer Invoices

- Create Payments/Receipts for above Invoices in Same Bank Account

- Reconcile above Bank Account with created Payments/Receipts

- Verify the Bank Account Current Balance.

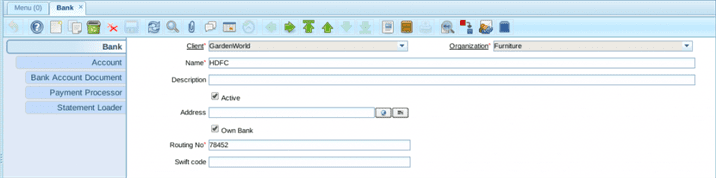

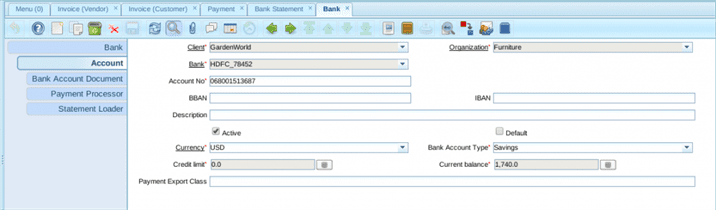

- Create new Bank in Bank window.

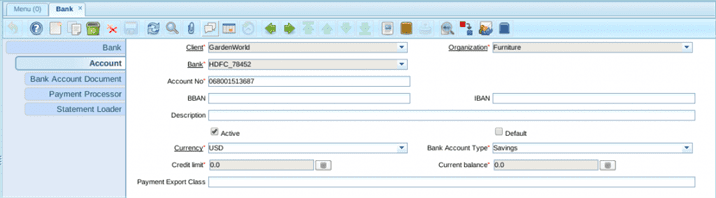

- Create New Bank Account in Account Tab of Bank Window.

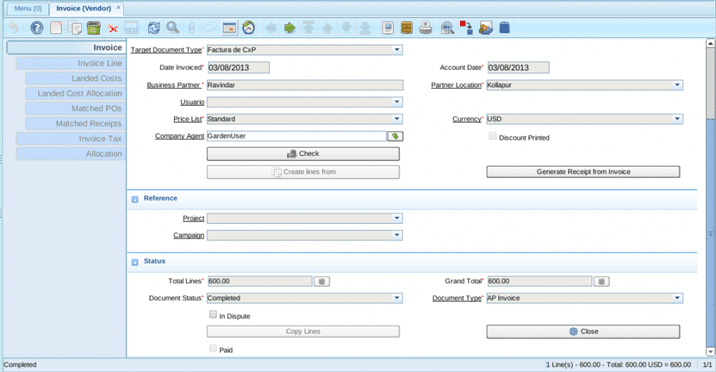

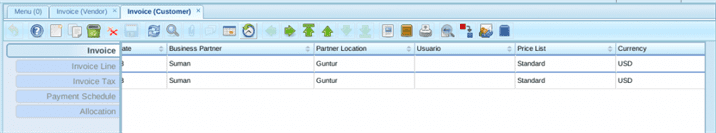

- Vendor Invoice is created for Ravindar Business Partner

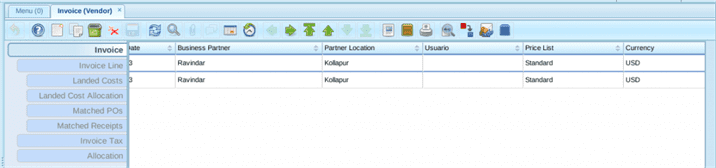

- There are two Vendor Invoices created for Ravindar.

- There are two Customer Invoices created for Suman.

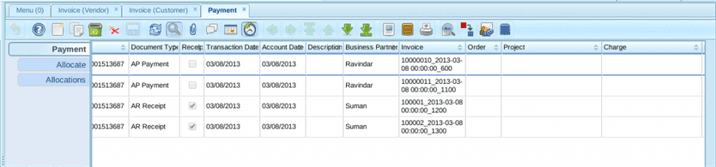

- Create Payments for Vendor Invoices ( Ravindar’s ) and Created Receipts for Customer Invoices ( Suman’s )

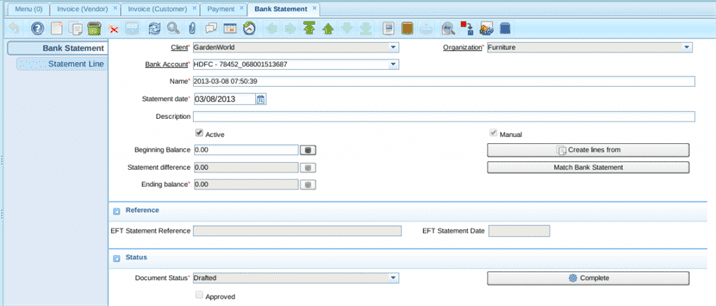

- Created Bank Statement for HDFC Bank Account in Bank Statement window for Reconciliation.

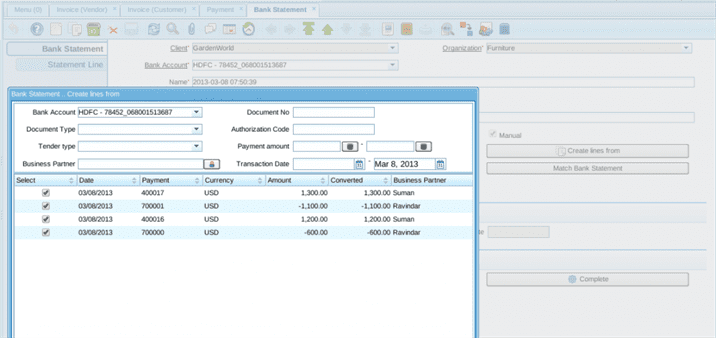

- Create Statement Lines in Bank Statement by clicking on Create lines from the button. We will see all Payments and Receipts which are created in Bank Statement’s Bank Account.

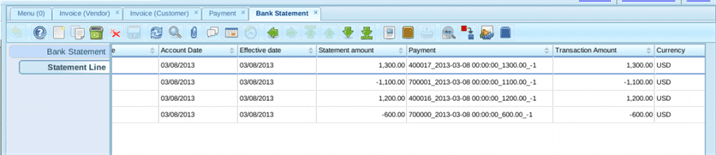

- Verify the created Statement lines in Bank Statement.

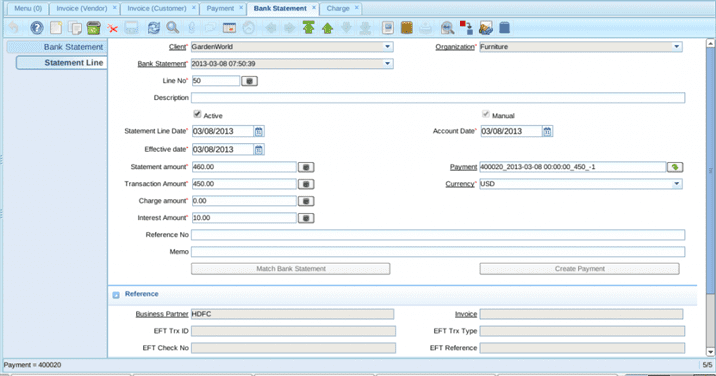

- If Bank pays Interest for certain amount, We can enter that interested amount in Interest Field. This certain amount will be one transaction in Bank Account.

In the above statement line,

Transaction Amount = $450

Interest Amount = $10

Statement Amount = Transaction Amount + Interest Amount = $450 + $10 = $460

After entering these details, we can click on the Create Payment button, It will create Receipt based on Transaction Amount of current Statement line.

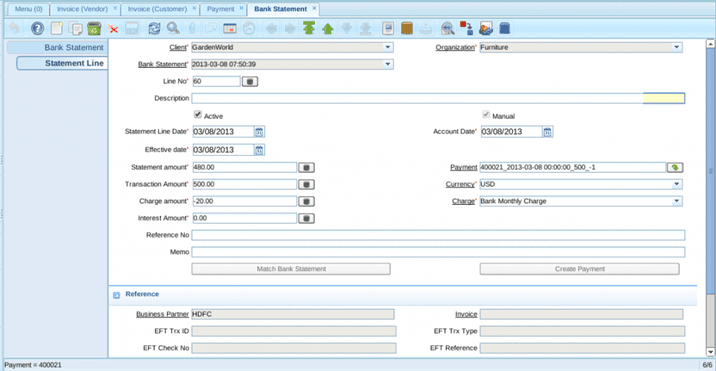

- If Bank charges for a certain amount, We can enter that charged amount in Charge Field. This certain amount will be one transaction in Bank Account.

In the above statement line,

Transaction Amount = $500

Interest Amount = -$20

Statement Amount = Transaction Amount + Interest Amount = $500 + (-$20 ) = $480

After entering these details, we can click on the Create Payment button, It will create Receipt based on Transaction Amount of current Statement line.

- Now Verify Total Statement lines.

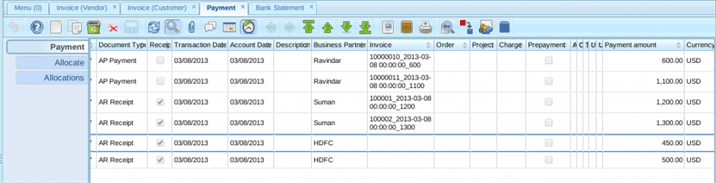

- Also verify Total Transactions ( Payments and Receipts ) in HDFC – 78452_068001513687 Bank Account on March 8th 2013.

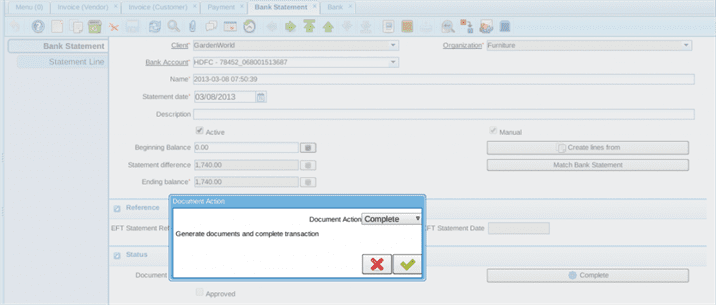

- Now complete the Bank Statement.

- Verify the Bank Account’s Current Balance, it should be correct.

Bank Account Current Balance = Sum of all Receipts Amount in this Bank Account + Interest Amount paid by Bank – Sum of all Payments Amount in this Bank Account – Charged Amount by Bank

Bank Account Current Balance = Receipts ($1200+$1300+$450+$500 ) + Interest ( $10 ) – Payments ($600+$1100 ) – Charged Amount ( $20 )

Bank Account Current Balance = $3450 + $10 – $1700 – $20 = $1740

Now All Transactions which were made in above Bank Account posted into actual Bank Account once Reconciliation is done.

Summary:

As a part of this article, we learned about the Bank Reconciliation process in ADempiere. It also includes applying Interest amount paid by Bank and Bank Charges and creation of payments from statement lines. Hope you have enjoyed reading this article.

Walking Tree promotes ADempiere and we support the users as well as the developers to ensure that the business is able to take complete advantage of ADempiere’s wonderful capability. In case you are looking for professional assistance then do visit our website to get in touch with us.

References :

- http://www.adempiere.com/Banking

- http://www.adempiere.com/ManPageW_BankStatement