Blogs

Meeting your accounting needs through Adempiere – Account Payables

As part of ERP implementation, we have come across a lot of simple as well as complicated demands from the customer. While Walking Tree has been successfully customizing Adempiere for its client, we intend to share some of our experience over here to enable the customer as well as development community to make effective use of Adempiere.

As part of this article, we will explain how Adempiere can be used to manage account payable (which will be suitable for Indian businesses) for a typical business organization. Well, when we talk about account payable, often we think about following terms

- Miscellaneous payment option against invoice without POs

- Capability to define payment schedules of invoice

- Multiple modes of payment

- Tracking over invoicing, return of products etc. through debit and Credit Notes

- Capability of putting invoice/payment to specific vendors on hold

- Accounting for over-payments, refund, claims etc

- Accounting of service contract payments e.g. transport canteen, casuals hostels ,utility bill payments for water, electricity, etc

- Printing of cheques

- Adjustment of dues from suppliers against past supplies on account of rejection etc.

- Statutory tax statements and payments (India-specific)

- Two/Three/Four-way invoice matching within AP as well as AR

Now let’s look at them one-by-one and see how Adempiere can be used to meet these needs.

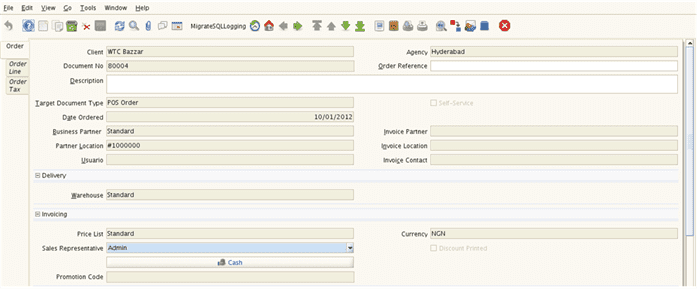

Miscellaneous payment option against invoice without POs

The question is – can we have an invoice without a PO and can we make a payment against such invoice. The answer is Yes to both these questions.

While the typical purchase process includes following steps

- Requesting for quotation from the vendor (Requisition-to-invoice -> RFQ)

- Receiving response to the quotation from vendor (Requisition-to-invoice -> RFQ Response)

- Raising PO (Requisition-to-invoice -> Purchase Order)

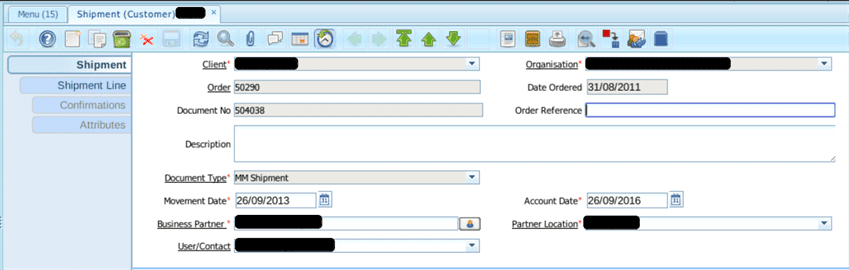

- Receiving Material (Requisition-to-invoice -> Material Receipt)

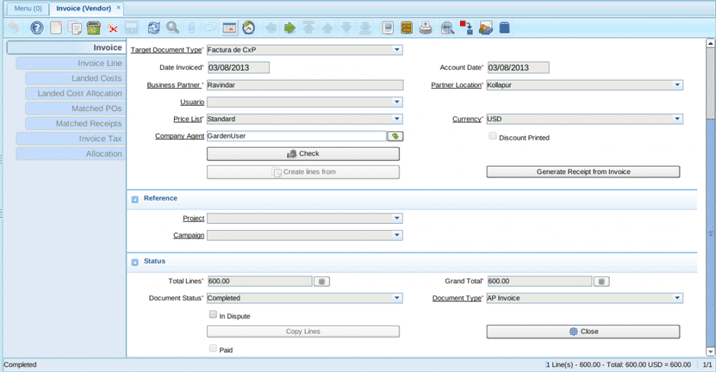

- Creating Invoice (received from vendor) – account payable! (Requisition-to-invoice -> Invoice (Vendor) )

- Making Payment to the payable (Open Items -> Payment)

The Adempiere provides you flexible ways of handling this situation. You can either decide to follow each step (strictly if you wish – through minor configuration changes) or you can decide to skip some of the upstream processes (e.g. quotation, PO).

Capability to define payment schedules of invoice

Using the window Quote-to-Invoice -> Sales Invoice -> Invoice Payment Schedule, you can define the payment schedule for a given (unpaid) invoice. Payment Schedules allow to have multiple due dates and associated discounts / deductions and due amount.

Multiple modes of payment

Adempiere provides in-built support for following payment modes

- Cheque

- Credit Card

- Direct Debit

- Direct Deposit

These payment mode (also known as Tender Type) has associated attributes (e.g. cheque details for cheque payment), which user can capture at the time of actual transactions.

Tracking over invoicing, return of products etc. through debit and Credit Notes

In nutshell, all the customer has a need for being able to return material to its vendor and if they are into trade then accept return from the customer. Adempiere provides you capability to create invoice of type AR CreditMemo and AR CreditMemo to handle this need. However, what is puzzling me is that the Invoice (Vendor) screen contains “AP CreditMemo” as choice in the Target Document Type drop down. Ideally – I should be able to create a receivable against the vendor. Looks like a potential gap!

Capability of putting invoice/payment to specific vendors on hold

Currently Adempiere does allow you to put an invoice in Disputed status. However it doesn’t allow you to put the invoice on Hold or put all the invoice of a given vendor on hold.

Accounting for over-payments, refund, claims etc

Adempiere allows you to manage overpayment in two ways. Say you have an invoice worth INR 100 and you make a payment of INR 150.

- You can either write-off 50 or

- Consider INR 50 as overpayment, which can be assigned to some other invoice.

Well the next question is how do we assign over payment to a different invoice? Adempiere provides you Payment Allocation window (inside Open Items) to achieve this!

There is no direct way to manage refund and claims. However, the system allows creation of invoice of type AP Credit Memo and AR Debit Memo. This can be used to define the concept of Refund and Claims.

Accounting of service contract payments e.g. transport canteen, casuals hostels ,utility bill payments for water, electricity, etc

Above need can be managed through the concept of Charges. You need to create invoice for charge instead of product. Adempiere allows you to define Revenue and Expense account for charges and accordingly account posting will happen.

Further, Expense Report and Expense AP Invoice concept can be used to manage some of the bills like utility bill, travel bill, etc. Adempiere further allows you to invoice these bills to your customer / vendor.

Printing of Cheques

This is one thing which I don’t see anywhere in Adempiere. Also there is a need to come up with detailed requirement for this. Some of the things that I can see are

- Creation of Cheque Book and leaf details

- Updates of cheque book leafs to capture cheque issue details (including handling of payment reversal)

- Reconcilliation with bank statement

- Printing of Cheques

Statutory tax statements and payments (India-specific)

Currently system allows you to define associated taxes through tax category and tax rates. Also, system allows you to define if the tax is included in the product’s listed price or we need to apply on top of the listed price.

However, the Government expect business to deduct certain percentage from the invoice (or expense). Hence the net payable should not include TDS amount and there should be separate payable of equivalent tax amount created in favor of Government (TDS). These TDS should be linked with the invoicing business partner so that system can generate Form 16 A on quarterly basis and send across the same to the business partner.

Two/Three/Four-way invoice matching within AP as well as AR

Adempiere allows you to match invoice with PO and Receipts.

Above requirement is the summary of some of the commonly asked features by our customers. If you have any specific requirement. I encourage you to put your query / response related to this topic to further strengthen Adempiere.

Adempiere is very interesting. A lot f my friends uses this as well for their tasks. I heard a lot of good review about it. Thanks for sharing this article. I will try this as well.

Great article.I think that Adempiere is definitely a good tool. I will try to use this as well for my business. Thanks for sharing this article.

I think that this is definitely a must try. I think that Adempiere will definitely make my accounting task faster to be done. Thanks for sharing this article.

I think that Adempiere is definitely a great and helpful tool for business owner. I am interested in using it. I think that this will help me do my accounting. Thanks for sharing this article.I’ll definitely try adempiere.