Blogs

Conversational AI: Exploring the Use Cases to Improve Experience of Insurance Customers

In the previous blog post, we discussed the shortcomings of traditional chatbots used by insurance companies and the way conversational AI can address these limitations. It is evident from several use cases of conversational AI in the insurance sector that it has extended the scope of automated customer support and improved the quality of customer interactions.

In the previous blog post, we discussed the shortcomings of traditional chatbots used by insurance companies and the way conversational AI can address these limitations. It is evident from several use cases of conversational AI in the insurance sector that it has extended the scope of automated customer support and improved the quality of customer interactions.

But how far conversational AI can transform the customer experience by making queries related to their policies or probing their claim settlement process? How can this technology help insurance companies to improve sales conversion? In what ways for the insurance customers the state-of-the-art conversational AI can become a better alternative than human support? Here in this blog post, we are going to address all these questions.

Going beyond automated answering for repetitive queries

Insurance products need to take into account different and widely variable risk factors, and based on this, the premium or cost of insurance coverage depends. So, for premium calculation or age coverage or eligibility requirements or claim conditions, customers have a lot of queries that insurers need to answer.

Since the answers for most of these queries are fairly objective and depend mostly on precise calculation, an answering bot with the ability to probe into customer details can do a good job here. This makes seamless customer onboarding possible with all the relevant information delivered to them without lag time and errors.

But the AI-powered data model can go beyond this quick computation and answering ability and probe deeper into the customer sentiments and catch intents based upon the series of queries. For example, an AI chatbot being asked about the inflation-adjusted maturity benefits from an endowment policy can detect customer concerns on financial returns and accordingly can suggest planning a balanced insurance bucket comprising both investment and risk coverage components.

Ultimately, this ability to probe deeper, detecting underlying customer intentions and generating precise suggestions, can play the role of a knowledgeable financial advisor for the customers. On the other hand, from the perspective of insurance companies, this opens up opportunities to increase lead conversion.

A boon to the insurance advisory and consultation process

Most people around the world are still less informed on how insurance can bring them security against unprecedented, uncalled-for, and fatal incidents. When agents propose an insurance policy, customers mostly get an air of the sales pitch in the making, and they resist. This resistance against the tenacious persuasion of the advisors portrays the banal process of insurance sales.

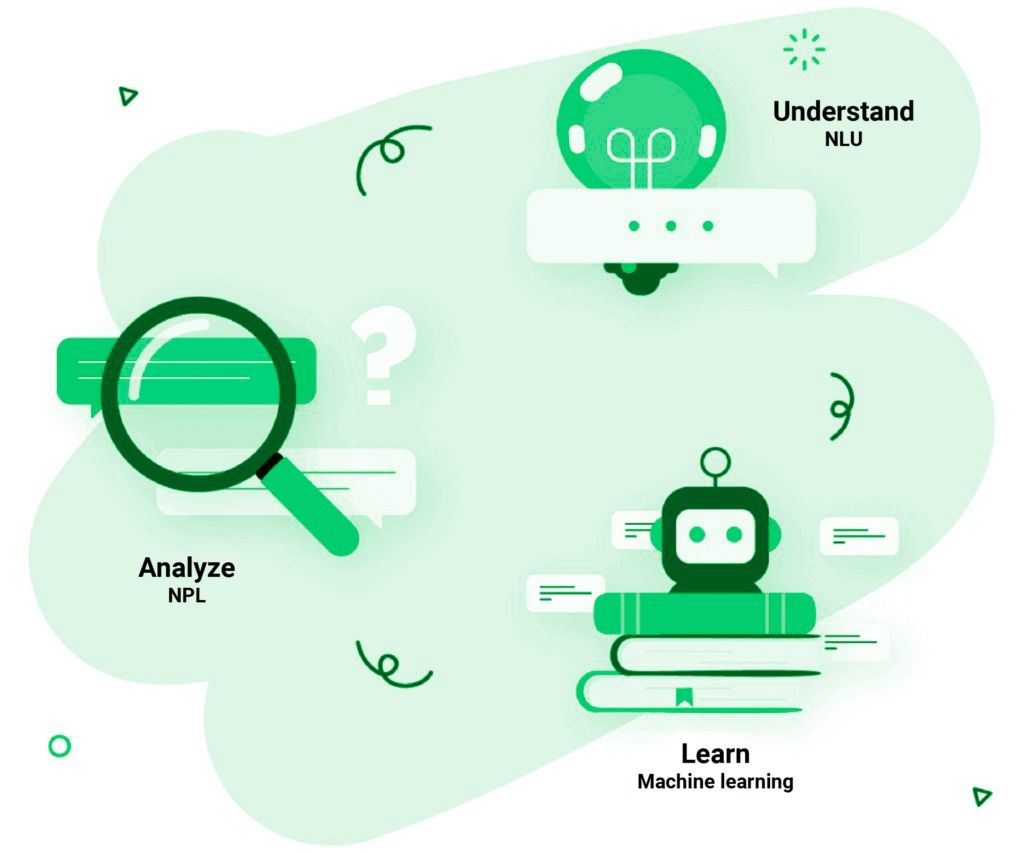

Conversational AI with its ability to apprehend customer sentiments and intentions through a round of carefully orchestrated probing queries, brings a paradigm shift to this sales approach. The latest AI bots, empowered with natural language generation (NLG)-based transformer tools like GPT-3, when trained adequately, can orchestrate a naturally flowing dialogue to make non-intrusive probes to detect the real customer requirement or tendency towards a particular insurance product.

Conversational AI with a good command of the narrative that works for convincing a customer to buy an insurance policy can be more effective than human advisors with their often less-informed and tenacious persuasions. This is also because AI bots are least intrusive and so affront no biased or predetermined resistance from the customers. More importantly, they are more apt for addressing the objections with insight-driven narratives based on customer data. The fairly objective and data-driven insights coupled with the narrative-building ability can make conversational AI a better advisor for insurance sales.

In this respect, we must not forget about the ease of embedding conversational AI in websites or mobile apps. These embedded AI bots can work like a personalized sales tool that just through conversation can amass customer data relevant for making further policy recommendations or alternative insurance policies.

An insurance company can bring a conversational AI interface across all digital platforms including social media or more personalized social messaging platforms for making more personalized and customer-specific recommendations. Last but not the least, by offering self-servicing opportunities to new prospects and existing customers for probing their insurance requirements, they generate more leads resulting in more sales conversions.

‘Always aware’ and ‘always alert’ customer support

Great customer support remains always alert and that’s what traditional wisdom says. But in the era of conversational AI, customer support tends to be more aware of individual customers as well. This brings a new dimension to the support experience for insurance customers.

Customer support automation through bots has become popular for some years as it offers a legible alternative to resource-intensive and error-prone live support teams sitting in call centers. Apart from saving a lot of resources, the bot support is prone to fewer errors unlike their human counterparts working under tremendous work pressure. But the major shortcoming of traditional bot support is its inability to handle complicated queries or not being capable to take forward a conversation to answer a deep-probing query.

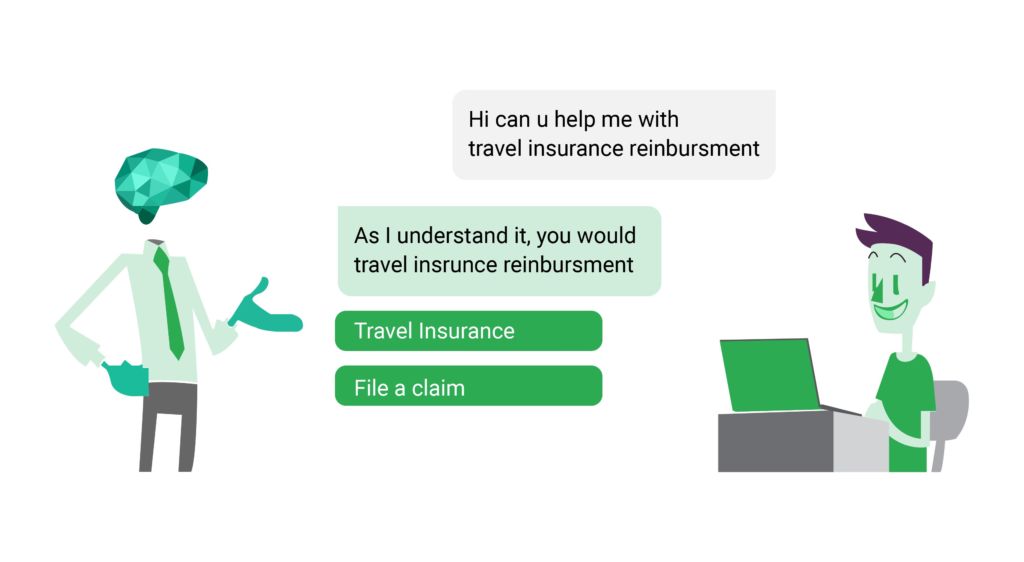

Conversational AI takes the impressive support automation of regular chatbots to a whole new level through understanding queries in a variety of linguistic expressions. If regular support chatbots just allowed insurance companies to scale up their query-handling capabilities, conversational AI made machine-run customer support capable of answering more complex queries with customer-friendly linguistic expressions. Thanks to conversational AI, customer support automation is no longer just about answering simple repetitive queries but also about giving layered answers based on individual customer data.

Looking Forward

How a business makes customer interactions effortless, relevant, and empathetic to their problems, determines the quality of customer experience (CX). In the context of insurance companies, this requires bringing together the ease of automation and human understanding of customer problems. This is what conversational AI delivers with its AI-driven precision and natural language dialogue.

Join Scott, Abhilasha, and Shubham to have an elaborate understanding of the topic on our webinar Conversational AI in Insurance: Challenges & Opportunities. To watch the webinar, click here.