Blogs

DevOps role in accelerating the changing face of BFSI

DevOps is trending and is being more responsive to the changing demands of the customer in the BFSI sector

The fast-changing environments, and situational demands for more digital services by consumers, and the effect of economical and technological changes have bought the need to accelerate the banking and financial systems to deliver services on a continuous basis which is best possible using DevOps.

We live in a rapidly evolving world where it is possible to anticipate sudden changes in many aspects such as technology, politics, economy, etc. and it becomes a mandate to respond to these changes quickly. This debate is particularly valid in the financial services industry, where the need to meet customer standards and provide uninterrupted service is higher. Millions of financial transactions happen every minute all over the world.

The race to offer features and user-friendly services to consumers more rapidly has already been injected into the whole financial service providers. In terms of creativity in modern software delivery practices and quick implementation of software upgrades, giants in IT industries are being very competitive and are moving at a very fast pace to promote businesses at great speeds with a degree of agility that wins the love and loyalty of their clients. Right from small trading companies to financial market players, big banks and exchanges are opting for DevOps practices, innovations to address the problems that occur in financial systems.

Why do financial industries need DevOps?

As discussed the use of legacy systems is creating concerns with regulatory compliance and security for most organizations, reducing the chances of in-house discoveries and new deployments. To adopt new trends quickly and intensify the speed of operations in financial services enterprises are looking forward to upgrading the current infrastructure, both front-end and back-end with advanced technology solutions.

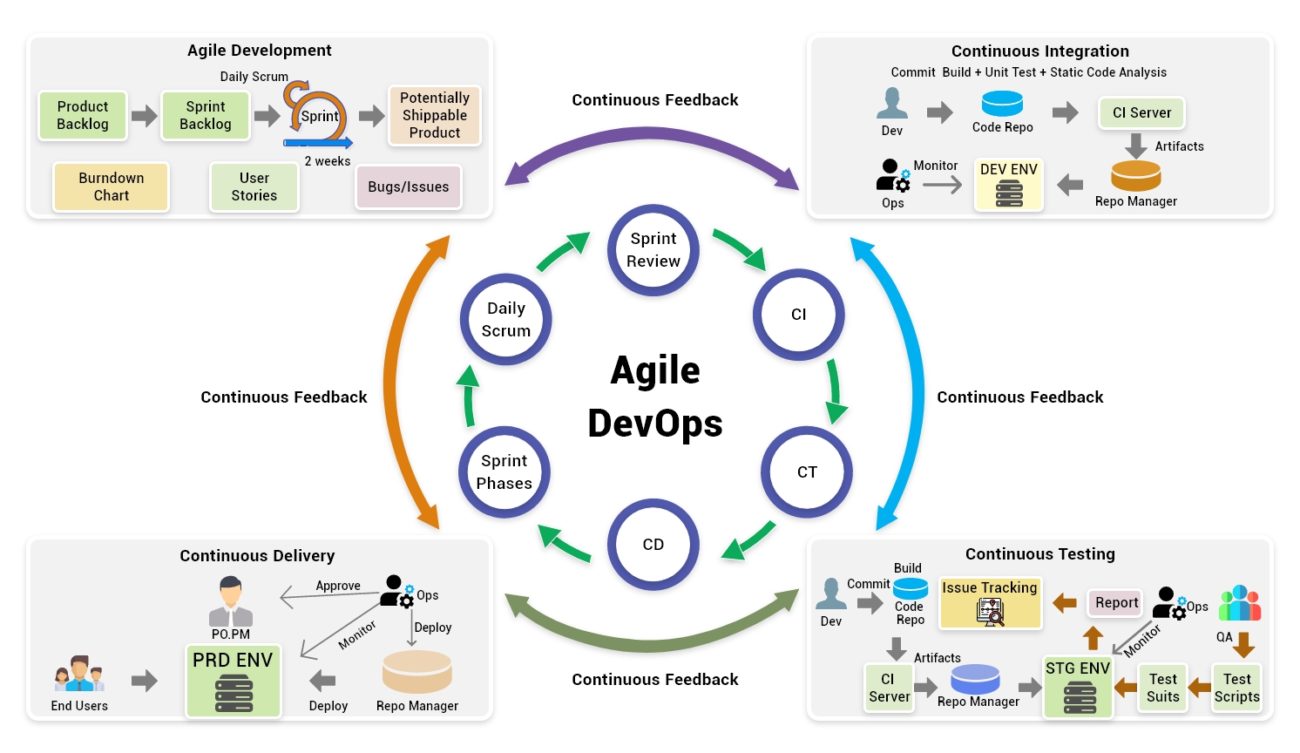

DevOps methodologies such as Continuous Delivery (CD) and Agile methodology, the technology revolution came as solutions that best suit the obstacles. Due to its characteristics such as CD, improved security, accelerated quality delivery, increased collaboration, and new working culture, among others, DevOps emerged as a boon to the increasingly growing industries such as the financial services industry.

Here are some of the DevOps practices and advantages that are included in the process.

- Connecting the app developers and operations teams the alignment is increased and also contains the process for receiving regular feedbacks from end-users which helps in quick fixations before sharing it with more customers

- The application performance is continuously monitored

- Participation of business stakeholders is increased in an active state

- The practices help create a single team for the full development lifecycle while applying Agile principles across the enterprise to make sure of the active participation of the whole team.

- Source code is continuously integrated by the developers

- Across development, test, staging, and production stages the deployment process is automated

By adopting DevOps financial industries can benefit in many ways such as higher customer engagement, continuous integration, uninterrupted services, etc. Top global banks such as Barclays, HSBC, Capital One, ABN AMRO Bank, and many of Europe’s largest banks adopted DevOps embraced DevOps in their production environments. They have been taking full advantages of DevOps practices and have been benefiting with higher customer engagement, continuous integration, uninterrupted services, etc

In my experience, DevOps implementations are helping enterprises develop and release with shorter iterations to increase speed in delivering products or services to meet customer expectations and faster to market than competitors. When it comes to financial and banking services, companies assume that embracing DevOps is more risky than getting benefits from it hence the reason few companies with legacy systems like follow the old practices and are lagging in the digital world. Nevertheless, when the question arises on why do financial industries need DevOps? and How the DevOps process can help the BFSI? then, the following are a few aspects that are discussed in detail.

- Accelerated Banks’ Digital Agenda with the Effect of Covid-19

- Banking and financial industries can simply leave the heavy lifting to DevOps while transformation

- Mitigating security threats while delivering fast secured services

- Reaping benefits faster by automating the processes

- Driving cultural transformation to work in a more fashionable way

- Orchestrating to simplify interconnected workloads

Accelerated Banks’ Digital Agenda with the Effect of Covid-19

Although for more than a decade, the necessity to shift to a more digital banking model has been talked about, and nevertheless, the BFSI sector has been making preparations for the transformation. Covid-19 left banks with no choice but to quickly implement digital solutions to meet consumer needs, putting limits on physical contact. It has created the need for decreased operational costs and enhanced digital experiences more important than ever. Today’s marketplace is with more demanding consumers hence the current financial institutions of all sizes must reevaluate their existing business models, core systems structure, distribution networks, dedication to innovation, and product collection. This is an important aspect as there is more agile competition and shareholders who are looking for greater efficiencies. As DevOps methodologies are designed for faster releases, banking and financial industries are making a great benefit by adopting DevOps for quick delivery of solutions to meet the ever-growing end-user needs. The rise in situational demand has brought DevOps and BFSI together as a great combination for unending customer service and strong internal infrastructure for seamless operations. While reaching urban areas was challenging to the BFSI sector, Covid-19 made the paradigm shift while calling out the urgency to accelerate the systems to work more efficiently and effectively along with third parties to make the services more feasible to the consumers.

Banking and financial industries can simply leave the heavy lifting to DevOps while transformation

Financial services companies are facing great challenges while meeting the new expectations set by the unicorns. Many of them are still in the process of transforming or modernizing their back-end systems to meet the digital world consumers. By using the legacy systems and code, these companies face issues on managing risk for better security, compliance with regulations, and meeting governance requirements. Where all of these make software innovation a complex and slow process. Over the last few years, the financial services industry has not only caught up the last few years but is leading the transition when it comes to driving innovation and embracing new software delivery strategies such as agile, continuous delivery (CD), and DevOps.

Today managers see DevOps as a conservative field to export value to the market faster, more effectively, and more securely. DevOps helps improve financial services in terms of speed and consistency of releases of applications. Also addressing strategies for governance, risk, protection, and enforcement. Now, let’s dig deep and see what’s next?

Mitigating security threats while delivering fast secured services

Compliance and security are major issues and have also been the first reasons against modernizing legacy software development and delivery procedures. In the initial days, DevOps activities were seen as a major security risk. With the increased pace of software releases, it was seen as security, governance, and regulatory controls.

Though organizations had an initial setback, some have implemented DevOps have repeatedly demonstrated and learned that these techniques actually minimize potential security issues and help businesses more rapidly locate problems and resolve threats, and therefore many businesses have adopted automation practices. This allowed the implementation criteria for enforcement, protection, and audit. Rather than a threat today, firms in financial services view DevOps as a resource for security efforts.

Reaping benefits faster by automating the processes

Automation throughout the software delivery pipeline is very important to intensify source utilization, product quality, and developer productivity. This also allows cross-project and enterprise-scale administration and visibility in financial services. Automation of all the processes is becoming a major requirement for any continuous delivery or DevOps initiative because this ensures compliance, enables scalability, speed, and makes enterprises feasible in achieving higher product quality. With DevOps adoption, enterprises are offered a more effective approach to mitigate risk from software releases. This will assist with the ever-evolving need for regular application updates.

Driving cultural transformation to work in a more fashionable way

DevOps mainly focuses on the formation of a culture in which industry, operations, developers, the Department of Quality Assurance and other involved members work together with the sole purpose of ensuring a reliable and efficient production of the project.

The foundation of DevOps is the formation of a culture in which industry, operations, developers, the Department of Quality Assurance, and other involved members work together with the sole purpose of ensuring a reliable and efficient production of the project toward a shared goal. Integrating security standards and automating the life cycle are the key steps when leveraging the technologies and resources to scale up DevOps adoption. Instead of completely focusing on the development of the project, DevOps analyses the whole project management process by paying attention to the synchronization of the team involved.

DevOps succeeds in changing the atmosphere of the organization, breaking down the silos to build a fluid environment for the workers. DevOps is a mindset and adopting a new culture definitely takes time.

This transition takes time and even the highly regulated financial services sector is introducing DevOps and leading the shift from the viewpoint of both culture and technology. Therefore the financial services firms have what they need to keep pace with the unicorns and modernize to get benefited taking full of DevOps’ advantages.

Orchestrating to simplify interconnected workloads

The four basic software delivery pipeline stages are built, test, deploy, and release consisting of hundreds of separate processes involving thousands of tasks and often hundreds of people carrying out millions of jobs. These individuals, systems, and toolsets often reside in geographically scattered silos to make it much more difficult.

These people can become skilled at understanding and improving their part of finding the solution when remaining in silos. However, from an organizational perspective, there is no end-to-end visibility and it is difficult to organize the complete course. This contributes to a lack of administration, mistakes, delays, manual handoffs, and fragmented procedures. Friction between teams can be eliminated by breaking down the functional silos by orchestrating each phase of the software delivery pipeline. This creates automation of repeatable, anticipated processes that operate regularly with minimum human intervention preventing several challenges distributed companies face.

Conclusion

In the beginning, many organizations faced strong opposition yet took a risk to implement DevOps. However, DevOps methodologies made a hit in transforming the banking and financial sector. DevOps enabled BFSI to provide a major volume of quality services in a more secured and more efficient way to the market which in turn is in unison with the approaches that settle governance, risk, security, and compliance. In the present day, many organizations around the world are implementing several technologies like big data analytics that are evolving rapidly which is widely applied to enhance several organizational activities. As part of their activities, many companies that embraced analytics have gained immense benefits from it and any new technology such as DevOps has to be embraced by organizations in the same way and in an effective manner to enhance their overall productivity.