AI-driven Advisory – Smarter, Faster, and Personalized!

Transform financial advisory with AI-driven hyper-personalization, automated risk insights, and real-time client engagement.

How we simplify Wealth Management Industry

Wealth management is often complex, data-heavy, and time-consuming, making it challenging to optimize investments and meet client goals efficiently.

Our AI-driven solutions streamline portfolio management by leveraging real-time data, intelligent automation, and predictive analytics. With dynamic asset allocation, tax-efficient rebalancing, and risk optimization, we empower wealth managers to make smarter decisions, enhance client engagement, and maximize returns.

Solution: AlphaTree, our AI-powered portfolio optimizer, enables real-time asset allocation, automated rebalancing, and predictive risk management with minimal human intervention. It continuously monitors market trends, interprets narratives, and adjusts portfolios, delivering proactive risk mitigation for smarter investments.

Solution: AgenTree, our agentic AI framework, leverages Generative AI and behavioral analytics to craft personalized investment strategies based on risk appetite, life goals, and market conditions. With our accelerators, AutoTasks and Aspira, AI agents can schedule calls and assist Relationship Managers as co-pilots, conducting interactive sessions to explain recommendations and address client questions.

Solution: Advisor Copilot uses AI-powered NLP and Generative AI to analyze, summarize, and categorize financial advisors’ notes at Document, Ticker/Asset, and Industry levels. It extracts actionable insights, highlights key opportunities, and offers intelligent recommendations to enhance decision-making. With Conversational AI, advisors can quickly retrieve past insights, boosting efficiency and client engagement.

Solution: Conversational AI-driven wealth assistants provide 24/7 client engagement, offering instant investment insights, portfolio tracking, and real-time recommendations to enhance customer experience. By integrating Explainable AI, Human-AI Collaboration, and AI-Powered Wealth Assistants, we help WealthTech firms, Robo-Advisors, and Digital Wealth Managers boost engagement, build trust in AI, and improve long-term client retention.

Solution: AI-driven smart automation for KYC, identity verification, and background checks accelerates client onboarding while ensuring regulatory compliance and fraud detection.

Solution: AlphaTree, WalkingTree’s AI-driven portfolio engine, optimizes multi-asset management by integrating real-time data, AI-driven insights, and reinforcement learning for dynamic allocation. It minimizes taxes, ensures liquidity, and maintains compliance while seamlessly working with Bloomberg, FactSet, and Open Banking APIs. AlphaTree empowers wealth managers with smarter automation, better control, and optimized returns.

Didn't find your challenge in our list? No problem, we've got you covered!

With expertise in fintech, AI, and GenAI, WalkingTree helps asset managers and investment firms optimize risk, enhance compliance, and elevate client experiences.

Agentic AI in Wealth Management

AI is no longer just a support tool—it's becoming a strategic co-investigator in wealth management. Discover how Agentic AI is setting new benchmarks in financial advisory.

- AI copilots are reshaping how investment teams discover alpha and respond to market shifts.

- Wealth managers are leveraging intelligent agents to automate complex research and compliance tasks.

- Autonomous systems are enabling deeper, real-time personalization for high-value clients.

- Firms are shifting from fragmented tools to cohesive AI-driven decision ecosystems.

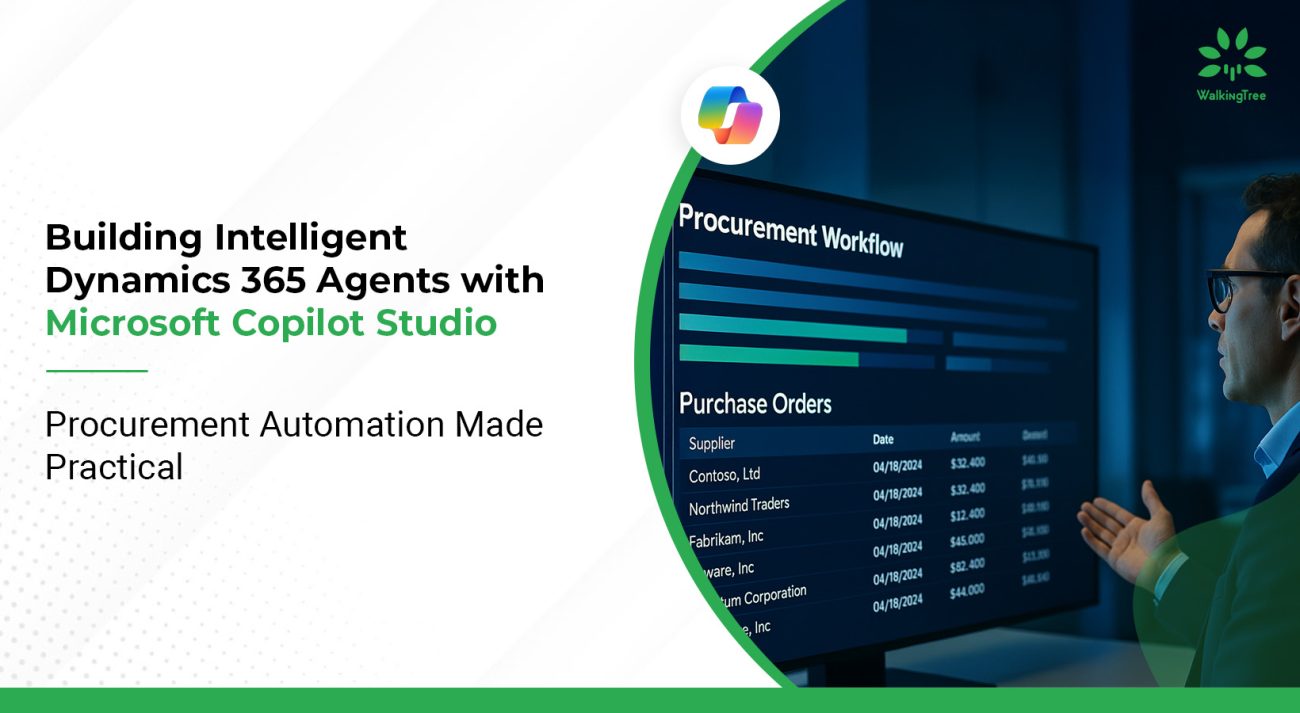

AI Accelerators & Frameworks (Our Competitive Edge)

AI-driven financial advisory

Intelligent financial advisory framework leveraging multi-agent AI for investment insights, risk analysis, and seamless client interactions.

What's new at WalkingTree

Warning: Undefined array key "cc_load_policy" in /var/www/html/walkingtree-tech/wp-content/plugins/powerpack-elements/modules/video/widgets/video-gallery.php on line 4236

Warning: Undefined array key "cc_load_policy" in /var/www/html/walkingtree-tech/wp-content/plugins/powerpack-elements/modules/video/widgets/video-gallery.php on line 4236

Warning: Undefined array key "cc_load_policy" in /var/www/html/walkingtree-tech/wp-content/plugins/powerpack-elements/modules/video/widgets/video-gallery.php on line 4236

Warning: Undefined array key "cc_load_policy" in /var/www/html/walkingtree-tech/wp-content/plugins/powerpack-elements/modules/video/widgets/video-gallery.php on line 4236

Warning: Undefined array key "cc_load_policy" in /var/www/html/walkingtree-tech/wp-content/plugins/powerpack-elements/modules/video/widgets/video-gallery.php on line 4236

Warning: Undefined array key "cc_load_policy" in /var/www/html/walkingtree-tech/wp-content/plugins/powerpack-elements/modules/video/widgets/video-gallery.php on line 4236