Blogs

Turning Voice into Value: How AI-Powered Call Intelligence is Revolutionizing BFSI Operation

Financial institutions deal with thousands of customer calls every day—yet, most of these interactions vanish into the ether after the call ends. They go unanalyzed, unaudited, and underutilized. What if every call could be a source of insight, compliance validation, fraud detection, or even a lead conversion trigger?

AI-powered call intelligence brings this vision to reality. It transforms unstructured voice data into real-time insights that help BFSI organizations improve decision-making, reduce operational overhead, ensure compliance, and elevate customer experience.

| The Missed Opportunity in Voice-Based Interactions

While data-driven decision-making is the norm across BFSI, most of that data is structured—CRM fields, transaction logs, or IVR inputs. Voice calls, on the other hand, are rich in context but traditionally ignored due to the complexity of processing unstructured audio at scale.

The challenges are clear:

- Unstructured Data Complexity: Voice data from calls, Zoom meetings, or VoIP lacks structure, making it hard to extract meaningful information.

- Disconnected Systems: Customer details might be scattered across CRMs, IVRs, and backend logs, making it difficult to get unified insights.

- Scalability Issues: As call volumes grow and customers use multiple languages or accents, traditional tools fail to keep up.

- Inconsistent Compliance Monitoring: Manual reviews are slow, prone to bias, and can’t scale to meet auditing demands.

- Lack of Real-Time Feedback: Without real-time insights, agents can’t pivot conversations or correct mistakes on the fly.

These gaps are not just technical limitations—they translate into financial loss, regulatory risk, and customer churn.

| How AI-Powered Call Intelligence Bridges the Gap

WalkingTree’s AI-powered call intelligence solution addresses each of these challenges through an integrated, modular architecture designed specifically for BFSI environments. Let’s break down the workflow and technologies involved:

1. Audio Capture and Processing

The system starts by capturing live audio from both the agent and the customer using a bot that joins calls on platforms like Google Meet or Zoom. These audio files are stored securely and streamed in real-time using Kafka for asynchronous processing.

2. Transcription with Whisper AI

Whisper AI converts multilingual audio into text. It handles slang, different accents, and background noise to ensure clean transcription. This becomes the foundational layer for all downstream AI processing.

3. NLP and Predictive Analysis with GPT

Using OpenAI’s GPT models, the system analyzes the conversation for sentiment, buying intent, behavioral cues, regulatory compliance, and fraud indicators. It assigns confidence scores to each insight and classifies interactions accordingly.

4. Real-Time Dashboards and Alerts

Insights are visualized via dashboards that track:

- Sentiment trends at the sentence and session level

- Agent performance and script adherence

- Fraud triggers and suspicious phrases

- Buying intent and lead conversion probability

All of this happens in real time—empowering supervisors and decision-makers to take immediate, data-backed action.

| Core Use Cases in BFSI

1. Fraud & Risk Detection

One of the biggest threats to BFSI institutions is fraud that originates from voice channels. AI can flag non-obvious anomalies that humans may overlook.

Features:

- Pattern recognition for scam language or tone

- Early-stage fraud detection and alerts

- Enrichment of traditional fraud models with conversational cues

Business Impact:

- Improves fraud detection speed and accuracy

- Reduces financial and reputational exposure

- Enables proactive escalation workflows

- Enhances audit trails for post-event investigation

2. Customer Experience Optimization

Every customer interaction contains emotional cues, friction points, and service gaps. AI uncovers these in real time.

Features:

- Sentiment and tone analysis per interaction

- Detection of dissatisfaction moments

- Real-time support for agent tone and response strategy

Business Impact:

- Boosts Net Promoter Scores (NPS)

- Increases first-call resolution rates

- Reduces customer churn

- Enables tailored agent coaching and training programs

3. Regulatory Compliance & Auditing

In the BFSI space, compliance isn’t optional—it’s mission-critical. AI ensures that agents follow mandatory scripts, disclosures, and policies.

Features:

- Automated script compliance monitoring

- Detection of unauthorized disclosures

- Searchable audit trails for every conversation

- Risk tagging of non-compliant interactions

Business Impact:

- Reduces risk of regulatory penalties

- Cuts down manual auditing workload

- Increases consistency and transparency in compliance enforcement

- Facilitates structured audit documentation and readiness

4. Sales and Conversion Enhancement

Voice interactions are goldmines for identifying potential leads—if you know how to listen. AI surfaces opportunities that would otherwise be lost.

Features:

- Buying intent scoring and lead qualification

- Pitch pattern analysis and script optimization

- Conversion likelihood prediction

- Real-time coaching prompts during live calls

Business Impact:

- Increases conversion rates without increasing headcount

- Enhances agent productivity and targeting

- Reduces missed sales opportunities

- Enables smarter follow-up and targeting strategies

| Real-Time Simulation in Action

In a typical implementation scenario, the system monitored a conversation between a banking agent and a customer inquiring about a recurring deposit product. Key insights included:

- Sentiment Progression: Neutral to positive as the agent explained features.

- Buying Intent Score: Reached 1 (maximum likelihood of conversion).

- Compliance Flags: Verified that the agent disclosed premature withdrawal penalties and followed script.

- Suspicious Phrases: None detected.

- Script Optimization: Identified that the agent used effective phrasing aligned with customer goals.

This isn’t just post-call analysis. These insights were surfaced in real-time and displayed via intuitive dashboards, allowing supervisors to track agent quality and customer satisfaction as calls happened.

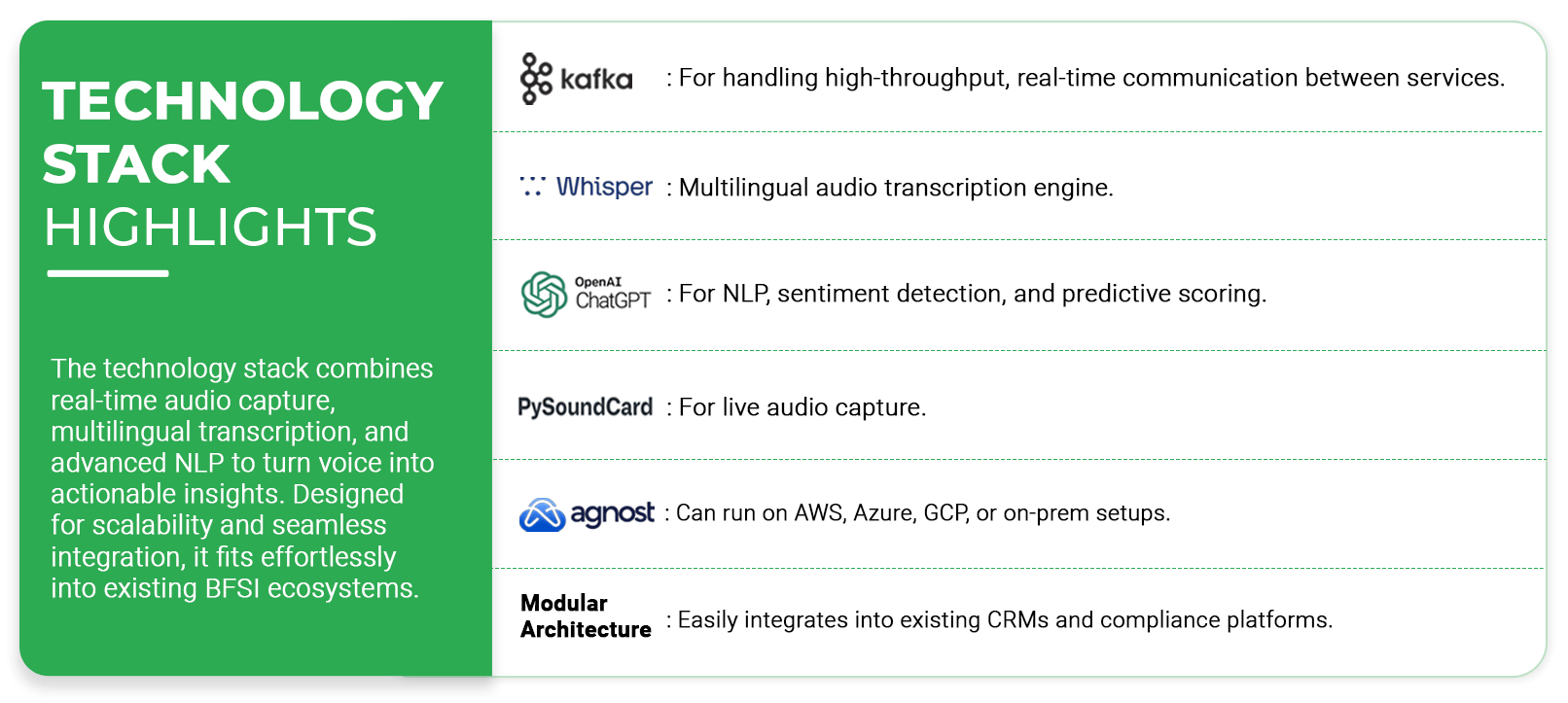

Technology Stack Highlights

- Kafka: For handling high-throughput, real-time communication between services.

- Whisper AI: Multilingual audio transcription engine.

- OpenAI GPT: For NLP, sentiment detection, and predictive scoring.

- Python SoundCard: For live audio capture.

- Cloud Agnostic Deployment: Can run on AWS, Azure, GCP, or on-prem setups.

- Modular Architecture: Easily integrates into existing CRMs and compliance platforms.

| Benefits Beyond Numbers

The solution doesn’t just tick technical boxes—it delivers real business outcomes:

- Improved Workforce Efficiency: Reduces manual effort in call reviews and training.

- Unified Insight Delivery: Consolidates multi-platform data (VoIP, Zoom, CRM) into a single pipeline.

- Smarter Decision-Making: Dashboards offer stakeholders real-time performance metrics.

- Faster Time to Action: Real-time triggers allow mid-call interventions and improved agent adaptability.

- Competitive Differentiation: Builds trust with regulators and customers alike through consistent, intelligent interaction handling.

| The Future: Human + AI Collaboration in BFSI

The future of voice intelligence in BFSI lies in real-time collaboration between human agents and AI copilots. Imagine an agent answering a customer’s question, and when unsure, handing it off mid-call to a bot trained on compliance documents and product FAQs. That’s not a far-fetched scenario—it’s already in motion.

AI won’t replace agents—it will empower them. It will make customer support more consistent, compliance more robust, and fraud detection more proactive.

| Final Thoughts

The BFSI industry is at an inflection point. As conversational data becomes a strategic asset, enterprises must embrace technologies that convert voice into value. AI-powered call intelligence is no longer a nice-to-have; it’s essential for those seeking to scale trust, efficiency, and revenue—all at once.

WalkingTree’s AI-driven platform is tailored to address the industry’s biggest pain points—while remaining modular, cost-effective, and easy to integrate. Whether you’re focused on compliance, customer satisfaction, fraud mitigation, or revenue growth, intelligent call analytics could be your biggest untapped resource.

Want to see AI Call Intelligence in action?

Watch our exclusive webinar recording where we dive deeper into the architecture, real-world BFSI use cases, and a live demo of our voice analytics platform.

About Suman Ravuri

Suman Ravuri, VP Engineering, specializes in digital transformation with over a decade of experience at WalkingTree. He has built high-performing teams, executed complex projects, and fostered a culture of continuous learning. Driven by empathy, Suman inspires his team to create impactful, innovative solutions.

View all posts by Suman Ravuri