Smarter Wealth Management: The Rise of Agentic AI

While wealth managers and investment firms have evolved over decades, the core analytical and advisory workflows remain largely manual, reactive, and fragmented — making it harder than ever to deliver personalized, proactive, and high-quality investment advice at scale.

In an era where markets move by the minute, news breaks in real time, and client expectations are shaped by on-demand digital experiences, traditional wealth management models are struggling to keep up.

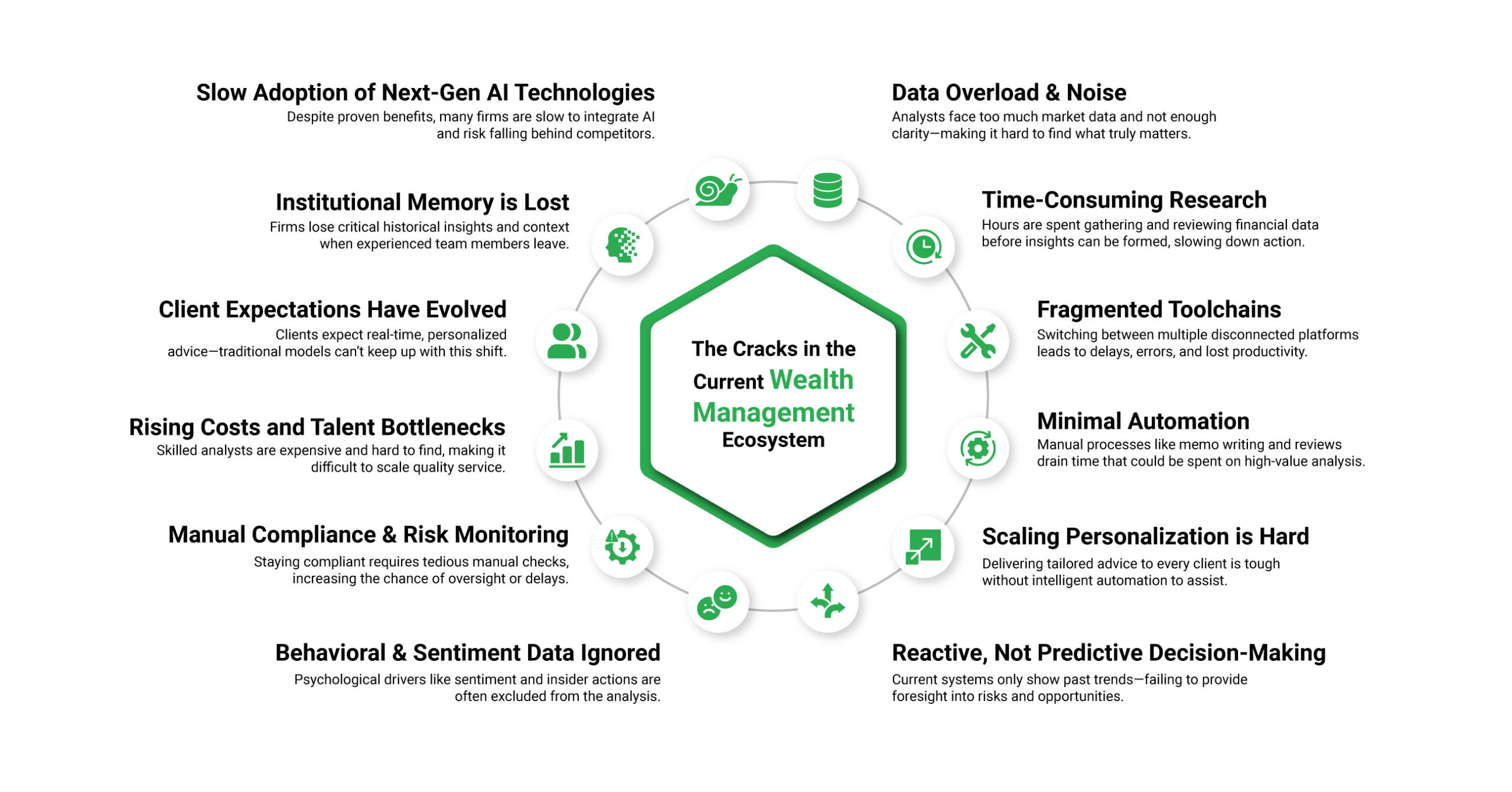

| The Cracks in the Current Wealth Management Ecosystem

Let’s break down the systemic problems that today’s firms and advisors are grappling with:

1. Data Overload & Noise

Analysts are drowning in information—real-time market feeds, earnings reports, regulatory updates, global economic indicators, and social sentiment. Finding truly actionable insights amid the noise is overwhelming, causing critical opportunities to be missed. In many cases, an analyst spends hours reviewing market data, only to miss an important Fed policy update that impacts client portfolios.

2. Time-Consuming Research

Reading financial reports, analyzing charts, comparing valuations, reviewing regulatory disclosures—these tasks take hours per stock or client. The result? Teams spend more time gathering and filtering data than generating insight or acting on it. For example – researching one mid-cap company’s fundamentals takes three days, by which time new earnings reports may have shifted the market dynamics.

3. Fragmented Toolchains

Market terminals, spreadsheets, CRM systems, news feeds, compliance tools—all disconnected. Analysts jump between platforms, wasting time and introducing errors. There is no single source of truth, which hampers productivity and decision speed.

4. Minimal Automation

A lot of firms still draft investment memos, earnings reviews, and portfolio commentary manually. There’s little or no use of AI to automate these repeatable, time-intensive tasks. This slows down responsiveness and limits advisor capacity. In such organizations, an advisor spends half a day manually drafting quarterly updates for each client instead of focusing on strategic portfolio adjustments.

5. Scaling Personalization is Hard

Clients expect personalized advice, not cookie-cutter reports. But keeping up with market changes and tailoring insights to individual clients at scale is nearly impossible without intelligent assistance.

6. Reactive, Not Predictive Decision-Making

Today’s systems tell you what already happened—not what’s about to happen. By the time risks are flagged or opportunities are spotted, it’s often too late.

7. Behavioral & Sentiment Data Ignored

Markets are driven as much by psychology as by fundamentals. Yet, most platforms overlook valuable behavioral signals—such as social sentiment, insider activity, or crowd psychology—limiting the advisor’s edge.

8. Manual Compliance & Risk Monitoring

Keeping up with evolving regulations is a constant headache. Manual compliance checks and post-facto risk reviews create exposure to errors, slowdowns, or even breaches.

9. Rising Costs and Talent Bottlenecks

Top-tier talent is expensive and in short supply. Many firms simply can’t afford large research or advisory teams—yet clients expect institutional-grade service and insights.

10. Client Expectations Have Evolved

Investors now expect real-time, mobile-first, hyper-personalized insights—influenced by their experience with apps like Netflix or Amazon. Slow-moving advisory models feel dated and disconnected.

11. Institutional Memory is Lost

Firms often lose valuable knowledge when analysts leave. There’s no systemized memory or learning loop, which leads to repetition of mistakes and inconsistency in decision-making.

12. Slow Adoption of Next-Gen AI Technologies

Despite proven advances in AI, LLMs, and intelligent agents, the wealth industry has been slow to modernize. This leaves many firms at risk of disruption by more agile, tech-native competitors.

| AlphaTree: An Agentic AI Ecosystem for the Future of Wealth Management

What if your firm had a virtual research team that never sleeps?

An AI-powered analyst that reads filings, tracks price movements, monitors sentiment, generates memos, and learns with every interaction? That’s the promise of AlphaTree—a new kind of platform built from the ground up using Agentic AI and Enterprise GPT tailored for equity research and wealth management.

AlphaTree doesn’t replace the human advisor. It augments them with intelligent agents that:

- Perform real-time fundamental and technical analysis

- Summarize earnings and news into actionable insights

- Monitor portfolios and generate commentary automatically

- Learn and adapt to market regimes, client preferences, and firm strategy

- Flag risks before they escalate, and identify opportunities before they’re obvious

With AlphaTree, wealth firms can scale insight, increase efficiency, and deepen client engagement—without needing to grow their team proportionally.

| The Time to Act Is Now

Wealth management is at an inflection point. Firms that embrace agentic AI will redefine what it means to deliver value in this space—faster research, smarter portfolios, and more satisfied clients.

Those who wait may find themselves outpaced by competitors who move faster, serve more clients, and make better decisions—with machines as their copilots.

If you’re looking to modernize your investment research, scale your advisory impact, and stay ahead of client expectations, AlphaTree offers the strategic edge you’ve been waiting for and it is designed for being a white labeled solution to ensure that you continue to differentiate.

Your team deserves intelligent tools. Your clients expect it. Let’s build the future—together.