Blogs

Agentic AI in Wealth Management: The Rise of Intelligent Financial Copilots

As the financial services industry rapidly evolves, the term “Agentic AI” is gaining traction—and for good reason. Unlike traditional AI applications that perform narrow tasks based on predefined rules or models, Agentic AI systems act as intelligent financial copilots. These systems promises to possess the ability to:

- Perceive their environment: ingesting real-time data from markets, client profiles, regulatory updates, political situations, catastrophic events and more.

- Reason and make decisions: interpreting patterns, prioritizing tasks, identifying impacts and choosing optimal strategies.

- Take actions autonomously: rebalancing portfolios, generating reports, initiating client communications.

- Interact dynamically: communicating with clients, advisors, and third-party platforms.

These systems are designed to be proactive, context-aware, and self-directed—functioning more like virtual partners than static tools. And in wealth management—a profession built on relationships, complexity, and data—Agentic AI represents a fundamental leap forward.

| Why Agentic AI Now for Wealth Management?

Wealth management is especially ripe for agentic AI adoption now because:

- Real-time, AI-driven analysis is essential to keep pace with today’s dynamic and data-rich financial landscape.

- Investors now expect personalized, goal-based strategies—Agentic AI enables the delivery of these at scale.

- With evolving client expectations, advisors face increasing pressure to maintain strong relationships while providing explainable, strategic advice.

- As regulatory bodies continue to tighten compliance and governance requirements, the need for proactive risk monitoring and mitigation has become critical to staying compliant.

- Always-on AI copilots are transforming client communication, education, and trust-building. Competitors are adopting these solutions aggressively—especially startups, which are challenging established enterprises to be more agile and effective.

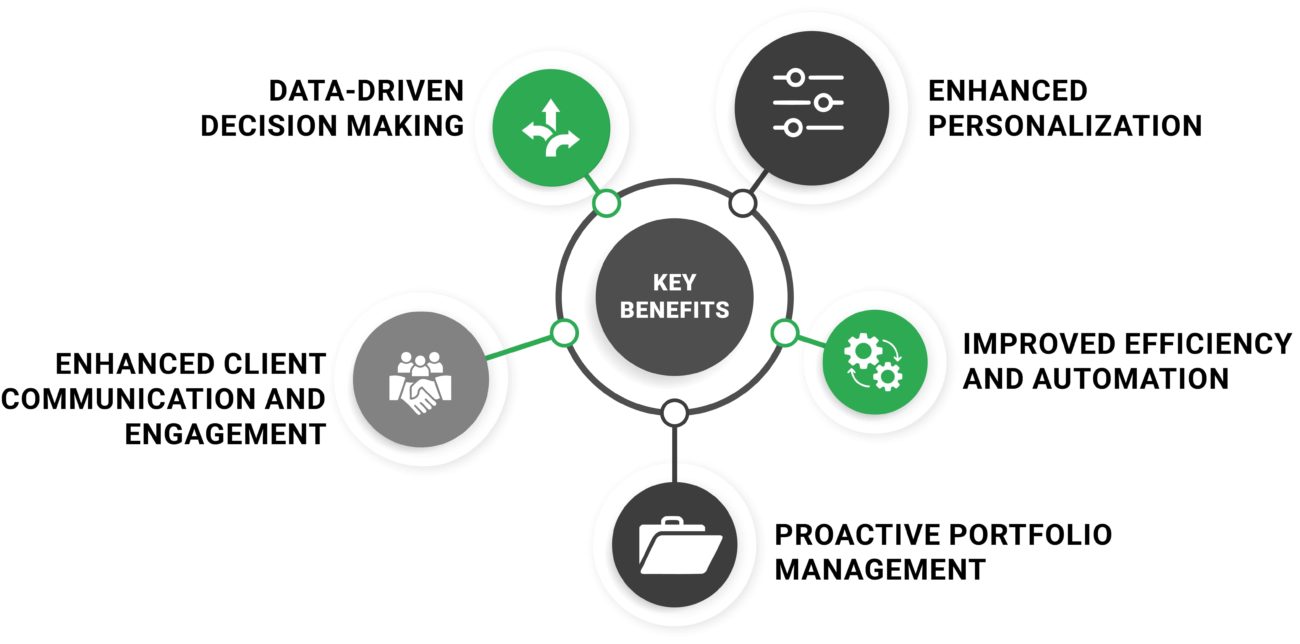

| Key Benefits of Agentic AI in Wealth Management

Agentic AI is poised to fundamentally transform wealth management, moving beyond simple automation to empower firms with intelligent, proactive capabilities. This technology offers a suite of powerful benefits, from deeply personalized client experiences and streamlined advisor workflows to dynamic portfolio management and data-driven investment strategies. Let’s explore how these capabilities are benefitting wealth management.

Enhanced Personalization

Agentic AI enables firms to deliver deeply tailored client experiences. By analyzing an individual’s financial profile, life goals, communication preferences, and risk tolerance, AI copilots can:

- Suggest personalized portfolio allocations and financial plans.

- Send real-time, proactive alerts for market events and investment opportunities.

- Continuously evolve recommendations based on new data and client behavior.

- Even get into a video conference with the client to help them understand their investments better.

Improved Efficiency and Automation

By automating the heavy lifting behind the scenes, agentic AI frees advisors to do what they do best: build relationships and provide strategic guidance. These agentic systems can:

- Automate data intake from custodians, CRM systems, and market feeds.

- Generate routine reports and compliance documentation.

- Manage workflows, including meeting scheduling and follow-ups.

Proactive Portfolio Management

Agentic AI doesn’t just wait for input—it takes initiative and identifies suitable tasks. As market conditions evolve, these intelligent agents:

- Rebalance portfolios within defined parameters.

- Adjust asset allocations dynamically in response to market signals.

- Flag anomalies or risks before they impact client portfolios.

- Involve humans wherever possible to ensure the best decision making.

Enhanced Client Communication and Engagement

Modern clients expect more than quarterly updates. Agentic AI enables:

- Conversational AI interfaces (chatbots, voice assistants) available 24/7.

- Personalized reports and portfolio updates based on individual preferences.

- Consistent, transparent communication to build trust and confidence.

Data-Driven Decision Making

Agentic AI brings unparalleled data-processing power to wealth management. These systems:

- Analyze structured and unstructured data at scale and create more structured data on the go to improve ML Models performance and build downstream workflow/automation.

- Detect macroeconomic and microeconomic trends.

- Provide advisors with evidence-backed, unbiased recommendations to improve decision quality.

| Key Concerns & Challenges and Our Solutions

As wealth management firms begin to explore the potential of Agentic AI, it’s natural to encounter questions around trust, transparency, compliance, integration, and the evolving role of human advisors. At WalkingTree, we believe that these challenges are not barriers—they’re critical design considerations that must be addressed head-on to ensure responsible, scalable, and impactful AI adoption. The following table outlines the key concerns facing wealth management professionals when implementing Agentic AI and how WalkingTree’s advanced frameworks, platforms, and accelerators provide practical, enterprise-grade solutions that are secure, explainable, and advisor-friendly.

| Challenge | Description | WalkingTree’s Solutions |

| Ethical Considerations | AI models may unintentionally introduce or amplify bias, leading to unfair outcomes and a lack of transparency in decision-making. |

|

| Regulatory Compliance | AI systems must comply with a complex and evolving regulatory landscape (SEC, FINRA, SEBI, MiFID II), requiring auditable and explainable outputs. |

|

| Data Security & Privacy | Client trust depends on how securely personal and financial data is handled, especially under laws like GDPR, CCPA, and SEBI’s privacy guidelines. |

|

| Role of Human Advisors | Concern that AI may replace financial advisors, diminishing trust and the human relationship vital to wealth management. |

|

| Model Drift & Degradation | AI models can lose relevance over time due to shifting client behavior, market conditions, and new data, leading to poor decisions. |

|

| Integration with Legacy Systems & Workflows | New AI systems can face adoption challenges if they don’t integrate easily with existing CRMs, portfolio systems, and communication platforms. |

|

| Data Overload for Advisors | Advisors struggle with massive volumes of unstructured data—client notes, research, market news—that slows decisions and reduces efficiency. |

|

| Scalability of Personalized Service | Delivering deeply personalized service to thousands of clients is nearly impossible without automation, leading to generic portfolios and low engagement. |

|

By proactively addressing these concerns through our human-centric, compliant, and secure AI design principles, WalkingTree helps wealth management firms unlock the true value of Agentic AI. From real-time compliance to advisor productivity, and from data security to personalized client engagement, our solutions are designed to deliver trust, efficiency, and superior financial outcomes. As the industry evolves, those who embrace Agentic AI with confidence and responsibility will lead the next era of wealth innovation—and WalkingTree is here to guide you every step of the way.

| Conclusion

Overall, we firmly believe that the future of wealth management is intelligent, autonomous, and human-centric.

- Advisors will rely on agentic AI copilots for real-time insights, risk management, and client personalization.

- Firms will gain scalable efficiency without compromising quality.

- Clients will experience deeper engagement, greater transparency, and better financial outcomes.

As this shift unfolds, the advisor’s role will evolve from data interpreter to relationship architect and strategic guide. Agentic AI will ensure every action taken is grounded in real-time intelligence and aligned with client goals.

At WalkingTree we firmly believe that Agentic AI is more than the next step in fintech innovation—it’s a reimagining of what wealth management can be.

- Explore a pilot project: Start with a specific area like client engagement or portfolio monitoring.

- Partner with AI leaders: Work with firms like WalkingTree that specialize in building agentic platforms, copilots, and domain-specific accelerators.

- Stay informed: Engage with case studies, demos, and roundtables focused on responsible AI adoption in finance.

The opportunity is here, and the time to act is now. With Agentic AI, wealth managers can deliver smarter service, deeper relationships, and superior outcomes.

Attend our upcoming webinar: “Autonomous Agents in Action: The Alpha Factor Advantage for Securities Analysis.” Register Now to dive deeper into this transformation.